A Guide to Art Auction Fees: Everything You Need to Know

Dollar (F. & S. II.278) © Andy Warhol 1982

Dollar (F. & S. II.278) © Andy Warhol 1982Market Reports

Auction fees can significantly impact both buyers and sellers, influencing the final price paid and the net proceeds received. While buyers must navigate fixed costs like the buyer’s premium, sellers face varying commission structures, marketing fees, and other expenses. Understanding these fees is crucial to making informed decisions in the art market.

Glossary of Key Terms

Here is our dummies’ guide to key terms, including the extras you’ll see less in auction houses' T&Cs.

Hammer Price: The final bid price, announced by the auctioneer when the gavel falls when a work is sold at auction. This price does not include the buyer's premium which is 25% plus VAT. Often prices displayed on auction results sites are inclusive of this, showing the hammer, plus 30% Equally, it does not demonstrate the return to the seller, that figure is less the negotiable 15% seller’s fee, less further costs such as LDL, marketing and any other costs due.

LDL: Stands for Loss, Damage, Liability, and refers to an insurance fee at auction. At auction this fee tends to fall to the seller, but it is also negotiable and can be waived. Some galleries and dealerships, including MyArtBroker, absorb the cost of this and will not add it as an additional fee.

ARR: Artist Resale Rights is a royalty fee that is applied and must be paid when dealing in an artist's work on the secondary market upon resale by an art market professional. The right to this royalty lasts for the same period as copyright, covering an artist’s lifetime plus 70 years after their death. It applies to sales of £1,000 or more, is calculated on a sliding scale, and is capped at a maximum royalty of £12,500 per sale.

Enhanced Hammer: A little known auction deal, negotiated by vendors with extremely valuable and sought after works, often to win business by auction houses, is when the vendor is not only offered 0% seller fees, meaning you won’t be charged any % of the hammer upon sale but also receive a portion of the Buyer's Premium.

Buyer’s Premium: The percentage on top of the hammer price that the buyer pays to the auction house to buy the work. The buyer’s premium is usually calculated as 25% of the hammer price plus VAT on that 25%. IE, if the work hammers for £100,000 the final invoice will be for £125,000, plus VAT on the £25,000. Final payment will be £130,000

Seller’s Commission: A fixed percentage based on the eventual hammer price of an item at auction that the seller pays to the auction house. This rate normally excludes marketing costs and insurance cover. It tends to start at 15% and can be negotiated depending on the works value, how much the auction house wants to secure it and the relationship you have with the house. Many auction houses offer 6% to trade and regular vendors. Some dealers and a handful of smaller auction houses have standard 0% seller fee policies, including MyArtBroker, to encourage the best access to the best works for their buyers, and therefore rely solely on the buyers premium to make profit.

Performance Commission Fee: Unique to auction houses, a performance commission fee is an additional commission charged to the seller when an item sells above its high estimate, essentially rewarding the auction house for exceeding expectations and achieving a higher sale price than anticipated. This often comes into pricing strategy when setting estimates and can reward the auction house an additional 2% on top of their buyers premium and sellers commission already paid in fees.

What are Art Auction Fees?

Art auction fees are the costs associated with buying or selling artwork at an auction house. These fees apply to both buyers and sellers, though they vary depending on the auction house, the value of the artwork, and potential negotiations.

Buyer's Fees or ‘Buyer’s Premium’

Buyers at an auction pay a buyer's premium, which is a percentage of the final hammer price. This is a fixed fee that cannot be negotiated. The standard buyer’s premium is 25% of the artwork’s hammer price. Additionally, buyers must pay VAT on the premium percentage, rather than on the total price of the artwork.

For example, if a buyer wins an artwork for £100,000, they will pay:

- A 25% buyer's premium, bringing the total invoice to £125,000

- 20% VAT on the 25% premium, adds another £5,000

- Resulting in a final cost of £130,000.

Beyond these fees, buyers may also be responsible for storage, marketing and insurance fees. Storage fees can accrue if they do not collect their artwork within a set period (often two weeks). Additionally buyers will be expected to pay shipping costs to their chosen destination.

Seller’s Fees or ‘Seller’s Commission’

Sellers face various fees when consigning artwork to an auction house. The standard seller's commission is 15%, but can be negotiated and is normally based on the value of an artwork. Additional costs may include:

- Marketing fees

- LDL fees

- Cataloguing fees

- Shipping costs to the auction house

- Storage ahead of the auction

While the seller’s commission is typically 15%, it is often negotiable depending on the value and desirability of the artwork. High-value artworks, especially those for prestigious evening sales, may be eligible for reduced or even waived seller’s fees. In some cases, an auction house might offer an enhanced hammer, meaning the seller not only avoids paying any fees but also receives a portion of the buyer’s premium. However, such offers are reserved for very high-value artworks, which is why auction houses often see limited profit margins at the very top end of the market, as they must offer significant incentives to secure these consignments from sellers above the competition.

For lower-value pieces, negotiating seller’s fees is much more difficult. Generally, auction houses will not approve reduced consignment fees for artworks worth less than £20,000. Trade sellers, who frequently supply artworks to auction houses, may receive preferential rates, but one-off sellers typically do not qualify for these discounts. While sellers can negotiate their fees, buyers must accept the fixed costs associated with purchasing at auction. Anyone participating in an auction should carefully review the specific fees of their chosen auction house before proceeding.

Why are Art Auction Fees Important?

Art auction fees are crucial because they significantly impact the final amount a buyer pays and the net proceeds a seller receives. Buyers and sellers may underestimate these costs, only to find themselves spending or returning much less than expected.

However, alternative models, such as those offered by MyArtBroker, can provide more cost-effective solutions. For instance, instead of high seller commissions, MyArtBroker agrees on a net amount the vendor would like to receive upfront and charges buyers a reduced premium - on average 18%. This is negotiated on a case by case basis.

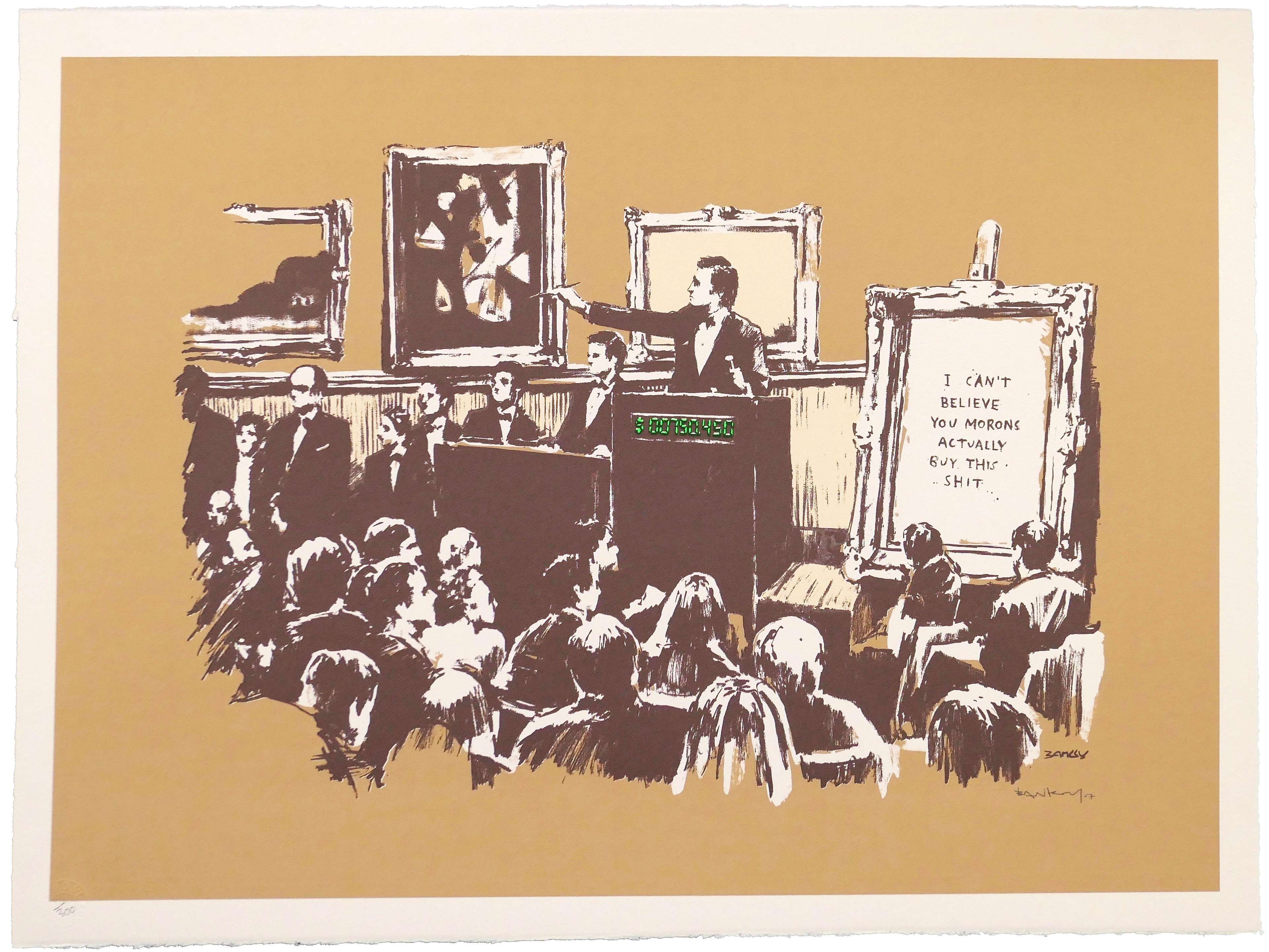

Another important factor to consider is Artist Resale Rights (ARR), which can add unexpected costs. ARR also applies to living artists and those who have passed away within the last 70 years and ensures that they (or their estates) receive a royalty whenever their artwork is resold in the secondary market. This means that if you purchase a work by Banksy or any other qualifying artist, you will be subject to an additional ARR fee. These hidden costs make it essential for buyers and sellers to carefully review auction terms and consider selling platforms to

Online Marketplaces

When it comes to online marketplaces, platforms like Artsy, Artscapy, and Artnet allow sellers to list their artworks for direct sale. Artnet, in particular, functions as an online auction platform, facilitating peer-to-peer sales. However, unlike traditional auction houses, these platforms do not physically handle the artworks - they do primarily perform cataloguing, condition checks, or full authentication.

Peer-to-peer sales can pose significant risks. Buyers might receive artworks that have serious condition issues, such as prints that are improperly framed or mounted, making them essentially damaged and therefore difficult to resell. Since no specialist assesses the piece before it changes hands, there is always a risk that the buyer will not receive exactly what was described. While some transactions may go smoothly, sellers and buyers must weigh the risks of a lack of professional handling against the lower costs and convenience of some online marketplaces.

Image © Flickr / Christie’s, London © 2006

Image © Flickr / Christie’s, London © 2006Christie’s, Sotheby's, Phillips & Bonhams: How The Top Four Auction Houses Compare

Christie’s

Short History

Christie’s made history as the first auction house to sell a painting for more than £1 million when Velázquez’s Portrait of Juan de Pareja sold for over £2.3 million in 1970. This record sale for a painting almost tripled the previous world auction record held by Rembrandt's Aristotle Contemplating the Bust of Homer, which had sold for over £821,000 in 1961. Since then, Christie’s have strived to be the auction house breaking records for each artist.

Record Breaking Sales

Christie’s has a long history of setting auction records, selling some of the world’s most valuable artworks. In 2017, the auction house made history when Leonardo da Vinci’s Salvator Mundi sold in New York for $450 million, making it the most expensive painting ever sold at auction. This record-breaking trend continued in 2022 when Andy Warhol’s Shot Sage Blue Marilyn achieved $195 million, securing its place as the second-highest auction price for an artwork. Christie’s has also made a significant impact in the digital art space. In 2021, the auction house sold Beeple’s Everydays: The First 5,000 Days for $69.3 million, marking the first time a major auction house sold a purely digital NFT. This sale was a landmark moment for the art world, solidifying NFTs as a legitimate force in the market and further cementing Christie’s reputation as an industry leader.

Christie’s Fees

Buyers

Buyer’s premium:

- 26% on the portion of the hammer price up to and including £800,000

- 21% on the portion of the hammer price from £800,001 to £4,500,000

- 15% on the portion of the hammer price above £4,500,000

Sellers

- The seller’s commission is calculated on each item as a fixed percentage based on the eventual hammer price at auction.

- Performance fee: 2%

Sotheby’s

Short History

Sotheby’s has long been at the forefront of record-breaking sales, particularly in the 20th and 21st centuries. In 2012, Edvard Munch’s The Scream became the most expensive artwork ever sold at auction at the time, achieving $119.9 million. Sotheby’s has also drawn global attention with high-profile estate sales, including those of Andy Warhol and David Bowie.

Sotheby’s Fees

In February 2024, Sotheby’s introduced a new fee structure to simplify commissions, capping the seller’s fee at 10% on the first $500,000 and waiving it for high-value lots, while setting a tiered buyer’s premium. However, after six months of feedback, the auction house admitted the changes fell short and announced that, starting February 17, 2025, it would revert to offering bespoke terms for sellers while maintaining its commitment to transparency and fairness.

Buyers

Buyer’s premium:

- 27% on the first £800,000 of the hammer price

- 22% on the portion of the hammer price from £800,001 to £6,000,000

- 15% on any amount above £6,000,000

- Late collection fee: $6-10 per day depending on lot size

Sellers

- The seller’s commission is calculated on each item as a fixed percentage based on the eventual hammer price at auction.

- Performance fee: 2%

Phillips

Short History

Founded in 1796, Phillips has historically been smaller than Christie’s and Sotheby’s but has carved out a niche by focusing on cutting-edge and emerging artists, often setting new benchmarks in these categories. In 2022, Phillips made history with its highest auction sale when Jean-Michel Basquiat’s Untitled (1982) sold for over £68 million. This sale reaffirmed Phillips’ position in the global art market, and since then, Phillips has continued to establish itself as a leading auction house.

Phillips’ Fees

Buyers

Buyer’s premium:

- 27% on the first £800,000 of the hammer price

- 21% on the portion of the hammer price from £800,001 to £4,500,000

- 14.5% on any amount above £4,500,000

- Late collection fee: $10 per day for each uncollected lot

Sellers

- The seller’s commission is calculated on each item as a fixed percentage based on the eventual hammer price at auction.

- Performance fee 1-2%

Bonhams

Short History

Founded in 1793, Bonhams is a leading auction house specialising in fine art and antiques. In 2013, Jean-Honoré Fragonard’s Portrait of François-Henri d’Harcourt sold for £17.1 million, setting a world record for both the artist and for a French Rococo painting at auction. With a strong reputation, Bonhams continues to attract collectors and achieve noteworthy sales across a range of categories.

Bonhams’ Fees

Buyers

Buyer’s premium:

- 28% on the first £40,000 of the hammer price

- 27% on the portion of the hammer price from £40,001 to £800,000

- 21% on the portion of the hammer price from £800,001 to £4,500,000

- 14.5% on any amount above £4,500,00

Sellers

- The seller’s commission is calculated on each item as a fixed percentage based on the eventual hammer price at auction.

- Performance fee 1-2%

MyArtBroker

At MyArtBroker, our specialists provide a free market valuation for your artwork, offering a level of transparency unmatched in today’s market. In addition to our valuations, through our online Trading Floor, you can access real-time insights into works by the artist you’re looking to sell, including pieces that are most in demand, wanted, or currently for sale: allowing sellers to trust the valuation that they are provided.

Additionally, the MyPortfolio collection management service grants you free access to our comprehensive print market database. This resource allows you to review auction histories for the specific work you’re looking to sell, including hammer prices, values paid, and seller returns. In a fluctuating market, this historical data is invaluable - and often comes at a cost elsewhere - offering insights into past and current values to further inform decisions based on market timing and conditions. In addition to our specialists guidance, you have concrete data.