Up To You © Javier Calleja 2020

Up To You © Javier Calleja 2020Key Takeaways

Javier Calleja's prints demonstrate strong market performance, with standard works fetching between £2,000 and £5,000, while rare editions achieve significantly higher values. His print Tomorrow More (2019) holds the record at £25,280, achieved in Korea where his market is strongest. Authentication requires verification of materials and official gallery documentation from authorised dealers like Avant Arte. Editions typically range from 50 to 100 prints, with special editions as low as 10. Strategic timing of sales following major exhibitions or significant painting sales, such as the record 2021 sale of Waiting For A While (2019), can optimise returns.

Rising Spanish contemporary artist Javier Calleja has captured international attention with his distinctive character-based artwork, which blends kawaii-style aesthetics with contemporary art sensibilities. While primarily known for his paintings and sculptures, his prints have become increasingly sought-after, offering collectors more accessible entry points into his artistic world. His print editions, featuring his signature wide-eyed characters, have helped democratise access to his work while maintaining the whimsical appeal that has made him a significant figure in the contemporary art scene. This guide aims to help sellers of Calleja prints navigate the secondary art market.

Calleja's artistic vision translates particularly well to the print medium, with his clean lines and bold use of colour lending themselves naturally to high-quality reproductions. His limited edition prints typically maintain the same level of visual impact as his original works, capturing the characteristic large eyes, expressive faces, and subtle colour gradients that define his style. Through careful oversight of the printing process, Calleja ensures that each edition maintains the pristine finish and subtle details that collectors have come to expect from his work.

Calleja’s transition into printmaking reflects a broader movement within contemporary art to make high-quality, collectable artwork more accessible. His first significant foray into prints coincided with the rise of online marketplaces and galleries, allowing his work to reach a global audience. His unique blend of innocence and pop culture references makes his prints highly appealing, particularly to younger collectors - an appeal that has been bolstered by collaborations with well-known galleries and publishers, who have helped ensure the consistency and quality of his editions.

How Much Do Javier Calleja Prints Sell For?

Javier Calleja's prints have seen a steady increase in demand, with prices reflecting his growing reputation in the art world. Recent auction results suggest that his prints typically sell for between £2,000 and £5,000, with rare and popular editions fetching much higher prices. Sales made in Asia, particularly Korea, see the highest returns, with Calleja’s aesthetic reflecting Asian cultural movements.

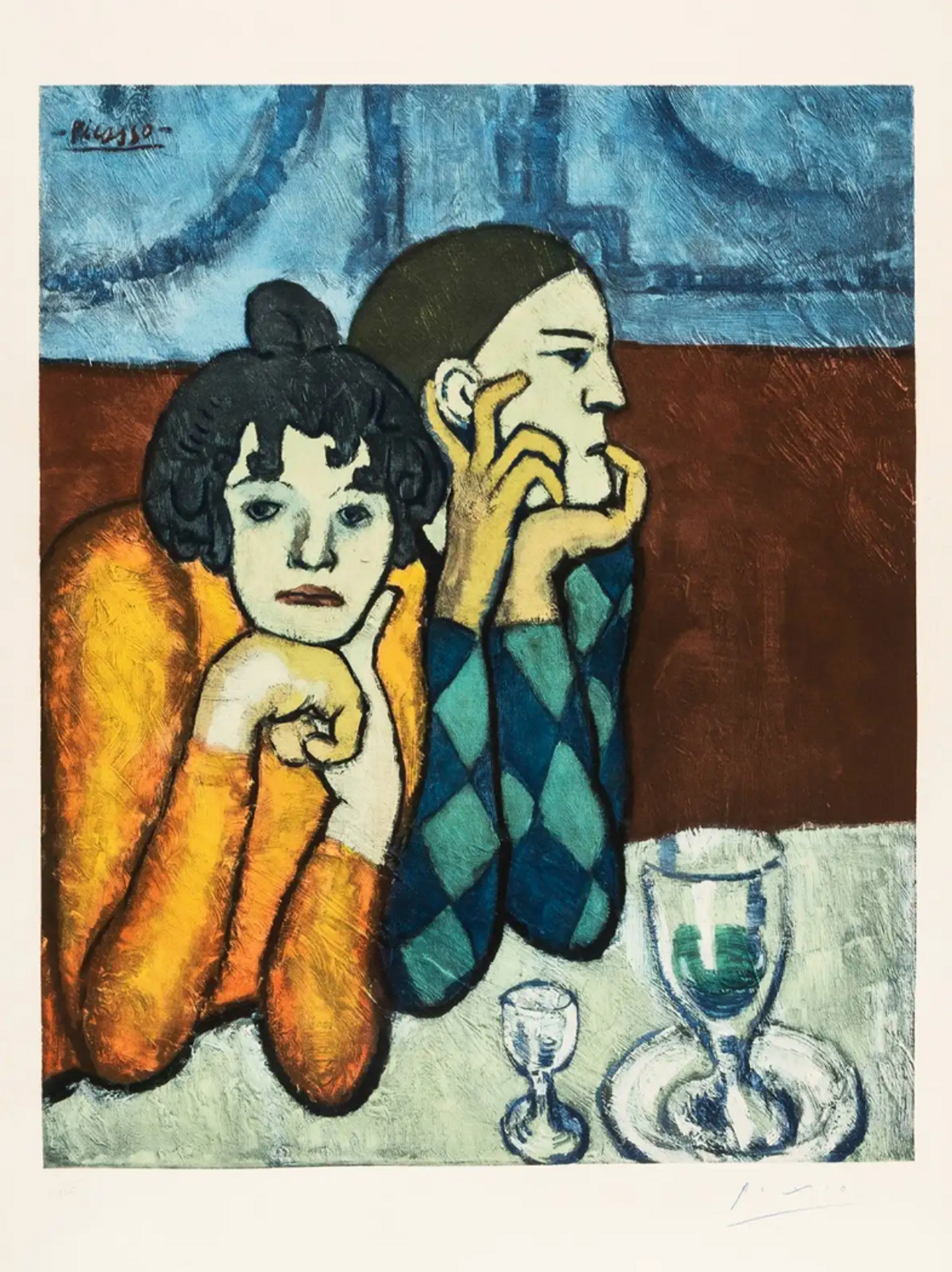

The record sale of a Calleja print occurred at K-Auction in 2021, when Tomorrow More (2019) sold for £25,280. Populated with Kawaii faces, sketchy line art, and pops of colour, Tomorrow More is a quintessential example of Calleja’s style. Up To You (2020), however, may be Calleja’s best-known print. Multiple prints from the edition sold in 2021 alone, achieving prices upwards of £17,000 - a print numbered 70/70 sold for £24,880 in Seoul. Other popular print series that feature similar compositions and imagery include Who’s Speaking… (2019), which sold for £23,864 in 2021, and I Can Wait Without Waiting (2019), which sold for £17,388 in 2021.

Artist’s proofs or printer’s editions are significantly rarer than standard editions and, as a result, achieve much higher prices. For example, a printer’s edition of Redhead (2014) sold in 2021 for £21,735, while a standard edition sold for £12,539 in the same year. Another key driver of value is hand embellishment. A series of Second Chance Always (2021), for example, is hand-finished, which adds uniqueness, texture, and context that always appeals to serious collectors.

The record sale of a Calleja print outside of Asia was the 2022 sale of Up To You (2020) at Christie’s London. The print sold for £17,000; however, while this value was still in excess of the print’s high estimate, the same print has achieved a higher value at auction in Asia. A broker or appraiser specialising in Calleja’s work will be able to advise you on entering the right market and help you manage the logistics of selling abroad.

How Do You Authenticate a Javier Calleja Print?

Authentication of a Calleja print begins with thorough examination of its provenance. Given the artist's rising popularity and the increasing value of his work, establishing authenticity is crucial for any potential sale. Documentation should include certificates of authenticity, original purchase receipts, and any gallery documentation from authorised dealers of Calleja's work.

Some technical analysis will enable you to position your print within Calleja’s body of work. As an example, check the type of paper against Calleja’s known preferences. Most of his prints are printed on high-grade paper such as Arches Velin. Similarly, look for the type and finish of the ink and any embellished details.

Collectors and sellers alike should seek to cross-reference their print against official records. While no formal catalogue raisonné for Calleja’s prints exists, you might turn to the records of reputable galleries and publishers who have exclusive relationships with the artist. Many of Calleja’s prints, for example, are published with Avant Arte in Amsterdam. Some editions will also feature a specially made embossed stamp unique to the artist and edition. Details such as this will be picked up by specialist brokers, appraisers, or publishers, such as Avant Arte.

Edition & Signature

Calleja’s signature typically appears in pencil, in the bottom right-hand corner of his prints. The edition number is usually written as a fraction on the left. The artist’s signature is distinctive, bold, and playful, reflecting the character of his art, often accompanied by a small pair of cartoon eyes. His limited editions generally range from 50 to 100 copies, with some special editions going as low as 10, making them especially rare and valuable. Artist’s proofs, marked “AP,” are also highly desirable due to their limited number and subtle variations from the main edition.

Browse Javier Calleja prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

Looking to Sell Your Javier Calleja Prints?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

Has Your Javier Calleja Print Been Kept in Good Condition?

The value of a Calleja print depends heavily on its condition, with particular attention paid to the preservation of his characteristic bold colours and precise linework. The vibrancy of his prints, especially in the distinctive eyes of his characters and their subtle facial expressions, must be maintained to preserve both aesthetic impact and market value. Any fading or discolouration can significantly affect the work's appeal to collectors.

Calleja’s prints are typically produced on high-quality archival paper, such as cotton-based or acid-free papers, which are durable but still susceptible to damage if not properly cared for. High levels of humidity can cause the paper to warp, and mould can spread - the damage from both can be irreversible. Vivid ink pigments, as used in Calleja’s prints, are more prone to fading if left exposed to direct sunlight or artificial light for prolonged periods.

When assessing condition, examine the paper for any signs of damage such as creases, tears, or indentations. Pay particular attention to the edges and corners, as these areas are most susceptible to handling damage. The surface should be free from any scratches or abrasions that could interrupt the smooth, clean aesthetic that defines Calleja's work.

For optimal preservation, store prints in a controlled environment away from direct sunlight and fluctuating humidity. If framing is desired, use UV-protective glass and acid-free mounting to prevent degradation. Handle prints only while wearing clean cotton gloves to avoid transferring oils or dirt to the surface.

For advice on how to get started with condition assessment of your Javier Calleja print, contact MyArtBroker.

When is the Best Time to Sell My Javier Calleja Print?

The market for Calleja's work has shown significant growth in recent years, particularly in Asia where his aesthetic strongly resonates with collectors. The timing of your sale should be influenced by several factors, including major exhibitions, institutional acquisitions, and broader market trends in contemporary art.

Recent exhibitions, such as his recent solo shows in Hong Kong and at major international art fairs like Art Basel and Frieze in London, have sparked renewed interest in his work. Events such as these tend to push market prices higher as his visibility increases.

As a prolific and active artist, one of the biggest influences on Calleja’s print market is the release and sale of original works. An enormous surge of interest across Calleja’s print market in 2021 can be attributed to the record sale of Waiting For A While (2019), which broke $1million for the first time in the artist’s career. The string of record print sales that followed took Calleja’s print market above £20,000 for individual prints.

The best way to keep track of sale trends is to follow auction results and value trajectory reports on the websites of major auction houses. These reports are freely available, and can reveal patterns of demand that can guide you in deciding whether or not to enter the market yet.

MyArtBroker offers advanced art tech tools to help you determine the optimal time to sell. Our MyPortfolio service features an AI-powered value indicator that provides real-time valuations of individual prints based on both public and private sales data. Combined with our complimentary valuations, we can help ensure your print achieves maximum value by selling at the perfect moment.

Ways to Sell with MyArtBroker

At MyArtBroker, our specialists provide a free market valuation for your artwork, offering a level of transparency unmatched in today’s market. In addition to our valuations, through our online Trading Floor, you can access real-time insights into works by the artist you’re looking to sell, including pieces that are most in demand, wanted, or currently for sale: allowing sellers to trust the valuation that they are provided.

Additionally, the MyPortfolio collection management service grants you free access to our comprehensive print market database. This resource allows you to review auction histories for the specific work you’re looking to sell, including hammer prices, values paid, and seller returns. In a fluctuating market, this historical data is invaluable - and often comes at a cost elsewhere - offering insights into past and current values to further inform decisions based on market timing and conditions. In addition to our specialists guidance, you have concrete data.

Our approach is tailored to align with the unique attributes of each artwork, and offer optimal results:

How a Private Sale Works

Unlike peer-to-peer platforms, which lack specialised expertise, authenticity guarantees, and legal infrastructure for high-value sales, MyArtBroker operates through private sales ensuring a secure and seamless transaction process. We charge sellers 0% to sell, and take a small commission from our buyers, absorbing essential aspects including insurance, shipping, and marketing - at no extra cost to the seller. There is no magic to it, we’re a lean specialised business with less overheads than traditional models meaning we can do better for our clients.

Our revenue is derived from buyer commissions only, which are individually negotiated upon offer, and we aim to give the client the best return in the market place. By focusing on high-value artworks in excess of £10,000, we provide specialised care and expertise, ensuring each piece receives the attention it deserves, while simultaneously maximising returns with our clients. For works that fall below this threshold speak to the team about a recommendation, we offer market advisory free of charge. Our goal at MyArtBroker is to offer a seamless solution, setting us apart in the art market.

Advisory and Recommendations

In cases for artists and artworks, where our existing network of collectors isn’t the best fit due to value, medium or condition we collaborate with reputable partners to facilitate its sale. Carefully tailoring your artwork to the right party. This tailored approach is especially important as it considers the unique attributes of each artwork, providing sellers with the best possible outcome in today’s shifting art market. You can discuss this approach with us without charge as part of our advisory service.

Such recommendations are on a case-by-case basis, and ensures broader exposure and takes advantage of our knowledge of where a work will do best.

Javier Calleja Collection Management with MyPortfolio

In addition to our live trading floor, MyArtBroker's MyPortfolio serves as a collection management system, empowering collectors to curate and oversee their prints and editions collection. This feature grants users access to our print market database, uniquely tied to our proprietary algorithm, SingularityX. This algorithm scans and analyses both public auction and private sales data to determine real time valuations of individual print works, factoring in various aspects such as condition, colour, and other factors affecting value.

Read What Powers MyArtBroker's Technology? In Conversation With Stuart Jamieson, Financial Quant to learn more about our algorithm.